Business Overview

SCBX was established in 2021 as part of the reorganization of Siam Commercial Bank, Thailand’s first indigenous bank. SCBX positions itself as a prominent financial technology leader in the ASEAN region and has transitioned beyond traditional banking to become a diversified tech-driven conglomerate.

Vision and Strategic Goals: SCBX aspires to be the "Most Admired Financial Technology Group in ASEAN," with a vision to serve 200 million customers across the region. The group is focused on expanding its technological capabilities through a three-phase strategy over five years, aiming to transform into a leading regional tech company with a market capitalization target of one trillion baht. This transformation is anchored in developing infrastructure centered around cloud computing, AI, and cybersecurity, with a newly established Center of Excellence driving these advancements.

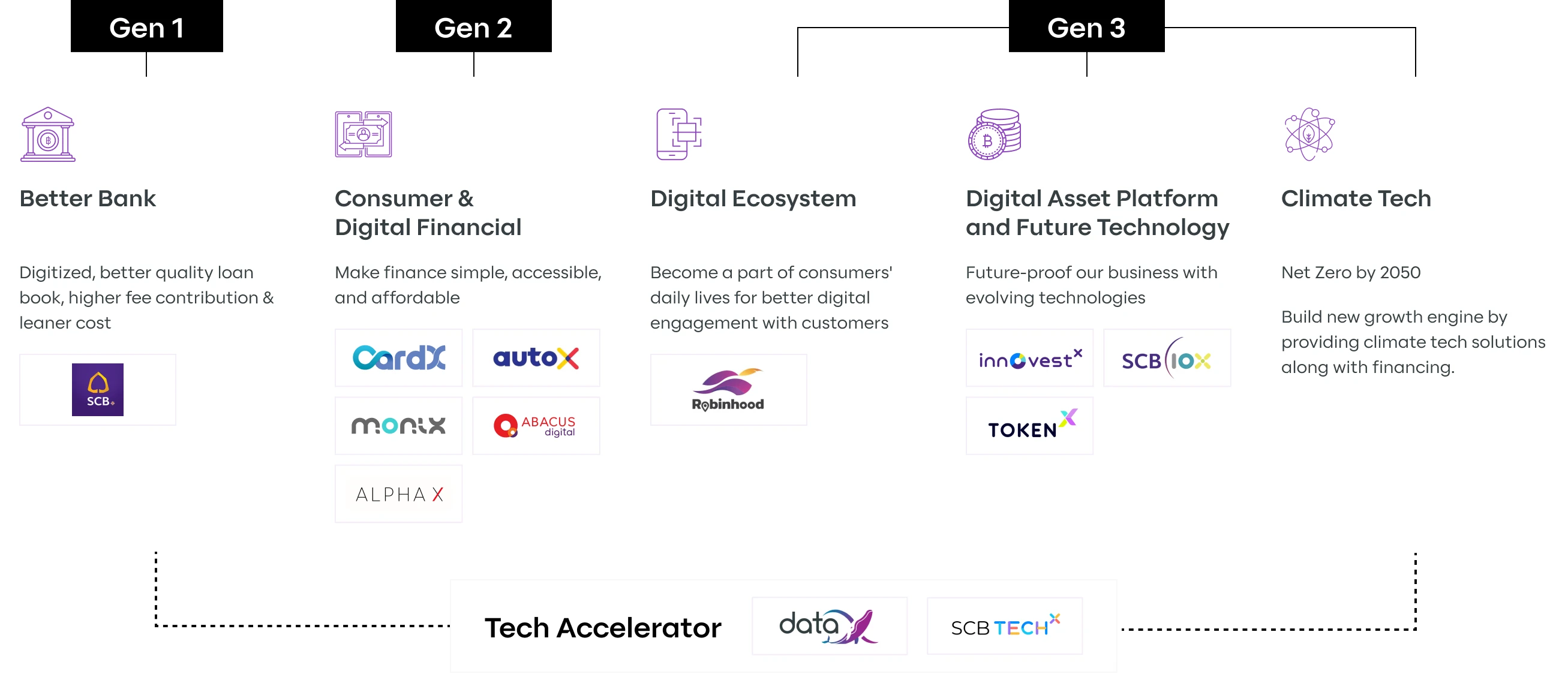

Subsidiaries and Business Pillars: The group’s diverse portfolio is structured across three generations of businesses:

- GEN 1: Banking Business, including Siam Commercial Bank and associated financial management and insurance services.

- GEN 2: Consumer and Digital Finance Business, featuring the following companies : CardX (credit and personal loans), AutoX (vehicle title loans), MONIX (digital lending via FINNIX app), ABACUS digital (digital lending via Money Thunder app), and Alpha X (luxury financing services).

- GEN 3: Platform and Technology Business, featuring the following companies : InnovestX (integrated investing platform), SCB 10X (technology investment), Token X (ICO Portal), and Point X (Point redemption service)

Tech accelerator: SCB TechX and SCB DataX are two accelerators helping other portfolio companies launch businesses at speed with economies of scale. SCB TechX supports the Group on technology capabilities while SCB DataX manages and enhances data capabilities for the Group.

Additionally, SCBX has made strides into ClimateTech, notably through initiatives like its investment in Rise, an ESG-related fund, signaling a strong commitment to sustainability and environmental responsibility.

Nature of Business

We are an investment holding company with portfolio companies divided into three segments (Gen 1-3) and four strategic themes.SCBX’s key responsibility is to seek investment opportunities that align with the Group’s business strategy and efficiently manage the Group’s capital for sustainable financial returns.